Obama, Netanyahu and Middle East Strategy

Bibi

Netanyahu’s visit with President Obama last week was not the most pleasant of

encounters for either of them.

Supporters of the State of Israel do not like the President’s feeling

about Israeli settlements (a lot of Israelis don’t like

the settlements either.) nor the President's voicing his concern about the many Palestinian civilian casualties in

Gaza. A current issue is a proposed Israeli apartment development.

The area which Israel plans to develop with an apartment complex is in an East Jerusalem neighborhood (Givat HaMatos) just over the line from the Israeli portion of Jerusalem in Israel along the major north-south highway leading out of Jerusalem to Bethlehem. This is not a "settlement" on the West Bank, but in an area far before any border checkpoint is reached entering the West Bank.

Furthermore,

the President is unhappy with Netanyahu’s reluctance to depart from the status quo and rush to compromise on the

issue of establishing a Palestinian state without first securing absolute and permanent guarantees that such a

state would not pose a military threat to Israel. To hear the rantings of Palestinian leaders,

and listening to what is being taught in their schools about ultimately

destroying the State of Israel, his position is totally understandable. And Barack Obama understands that. Netanyahu further continues to emphasize the importance of preventing Iran from going nuclear, a position which Obama must be very tentative on, because of his possible need for Iranian cooperation in attaining a Middle East solution. Bibi believes Iran to be part of the problem and not part of the solution.

Obama is dealing with a host of problems in the Middle East, and he views

Israel within the context of all of them.

In the preceding blog, I mentioned several “bargaining chips” which the

President must take into consideration in determining the direction of our

overall Middle East strategy in dealing with the Islamic State, Bashir al-Assad and the

future of the region. I wrote:

"There

are a lot of bargaining chips which can be used

in going in this direction. They are

related to Iran’s nuclear aspirations and desire to be

the dominant power in its region, Russia’s

desire to re-form what was once the USSR, the

removal of Assad from power in Syria, the role

of Turkey, the lessening dependence of the world

on Middle Eastern petroleum, the borders of an

independent Kurdistan and the future

relationship of Israel to the Islamic states around it."

To

be most effective in the Middle East, Obama’s position is enhanced by the

appearance of a distancing between Israel and the United States. The reality, however, is that the both Houses

of the Congress and the American people would never permit this to happen. Netanyahu know this. Obama does too. It is difficult to determine where posturing ends and truth begins.

In

regard to the upcoming Senate and House races, the position the President takes

on this issue can only add to the problems with which he has already burdened

Democratic candidates, such as supposed problems with the Affordable Care Act

and assorted inefficiencies, major and minor, in various parts of the Executive

branch’s operation. If the Republicans

don’t secure control of the Senate in November, it will not be because the

President hasn’t given them enough issues on which to campaign against

Democrats, Israel included.

Jack Lippman

News from the Butterfly Garden - Giant Swallowtail Visitor

The other day a Giant Swallowtail visited our Butterfly Garden. This Papilio Crespbontes was attracted by the wild lime tree and the calliandra which it is pictured circling. The camera on my iPhone didn't do justice to the butterfly's bright yellow trim on its otherwise black wings.

Otherwise, there remain an occasional Monarch in the garden as well as a few Zebra Longwings, the state butterfly of Florida. The zebra-like yellow and black stripes on that species' wings suggest the prison uniforms ultimately worn by some politicians in the State of Florida. I suppose that is why it is the state butterfly here.

JL

Guaranteed Life Insurance For Seniors

This

item is directed at our Senior Citizen readers.

But it is of value to anyone who might have relatives in that category,

so spend a minute or so reading on.

Lately,

there have been more and more ads on television (not to speak of the internet or

traditional mail) making available limited amounts of insurance for seniors,

usually up to a maximum of $50,000, which can never be cancelled, nor subject

to a premium increase, and most importantly, requiring no medical questions

whatsoever of applicants. Every applicant

is accepted, even those on death's doorstep! How can they do it?

The

catch on all of these policies (which

is not mentioned in the advertisements unless you read the very small print

flashed on the screen for a few seconds) is

that for the first two years, the only death benefit the insurance company pays

is a return of premiums paid, plus a little interest for deaths not

resulting from accidents. So death claims on the really sick people who apply, and die within 24

months, are avoided! As for

those who survive two years, their beneficiaries will indeed get the full death

benefit, but these insurance companies are not giving anything away there

either. Read on.

These

policies are advertised as “whole life insurance policies” and that is what they

are. That means that, within the structure of the policy, a portion of the premium for

each year is used to provide a certain amount of pure term insurance for that

year at the insured’s age with the rest being put aside to accumulate a cash value fund, which will be paid out as part of the

death benefit to the beneficiary.

Now, this cash value is calculated to grow on a guaranteed basis until a very advanced age, usually 95 or 100, at which point it is sufficient to equal the policy’s full death benefit. Before that point is reached, however, the insurance company figures our exactly how much pure term insurance is needed over and above that cash value to make the full death benefit available anytime the insured dies, and that comes out of the premium payment.

Now, this cash value is calculated to grow on a guaranteed basis until a very advanced age, usually 95 or 100, at which point it is sufficient to equal the policy’s full death benefit. Before that point is reached, however, the insurance company figures our exactly how much pure term insurance is needed over and above that cash value to make the full death benefit available anytime the insured dies, and that comes out of the premium payment.

Insurance company

actuaries know precisely how many individuals at any age will die before their next birthday, and how much that term insurance to pay for these death claims should cost at every age, and precisely how much

of that term insurance will be necessary to supplement the growing “cash value” portion

of the death benefit so that it equals the policy's full death benefit at any point while the it is

in effect. That term cost is provided by setting aside a portion of the guaranteed level premium for the policy, with the rest of the premium

going into the cash value part of the death benefit.

This is how these policies work and there is nothing unusual or wrong about this

because that is more or less the way all whole life insurance policies work. The premium remains the same, resulting in a

level premium which in the policy’s early years is far in excess of what pure

term insurance for the full death benefit would cost, and in the policy’s later years, is far less than what

pure term insurance for the policy's full death benefit would cost. The ever-increasing cash value makes the

amount of term insurance needed less with each passing year, and that is necessary because at older ages, term costs become very, very expensive. By the time the cash value approaches the full death benefit, term costs will be prohibitive, but fortunately, there would be little need for term insurance at that point.

But

the insurance companies and their actuaries are not dummies and know that even

those insureds who survive two years may not be in the best of health, or else

why would they be buying this kind of policy, they reason. (Usually, applicants have some sort of medical history involving cancer, heart disease or kidney disease within the past few years which would disqualify them from getting a "regular" policy.)

So to compensate for this, they take the pure vanilla cost of the term insurance part of the death benefit, a cost based on insurance applicants who have answered health questions and who have been found to be fully qualified for a life insurance policy, and perhaps double that cost or increase it in some significant manner to be able to pay for the increased amount of death claims which life insurance policies issued to a policyholders who never had to answer health questions will produce, even after two years!

This artificially increased cost of term insurance, along with an amount necessary to fund that growing cash value, is developed into that guaranteed level premium for this kind of policy, which may or may not be a good deal, depending on when the Grim Reaper decides to pay a visit.

Illustrations such as this rarely, if ever, appear in life insurance advertisements, but really they should since this is what their product is all about.

Illustrations such as this rarely, if ever, appear in life insurance advertisements, but really they should since this is what their product is all about.

So to compensate for this, they take the pure vanilla cost of the term insurance part of the death benefit, a cost based on insurance applicants who have answered health questions and who have been found to be fully qualified for a life insurance policy, and perhaps double that cost or increase it in some significant manner to be able to pay for the increased amount of death claims which life insurance policies issued to a policyholders who never had to answer health questions will produce, even after two years!

This artificially increased cost of term insurance, along with an amount necessary to fund that growing cash value, is developed into that guaranteed level premium for this kind of policy, which may or may not be a good deal, depending on when the Grim Reaper decides to pay a visit.

Illustrations such as this rarely, if ever, appear in life insurance advertisements, but really they should since this is what their product is all about.

Illustrations such as this rarely, if ever, appear in life insurance advertisements, but really they should since this is what their product is all about.

Just

thought this information would be useful.

JL

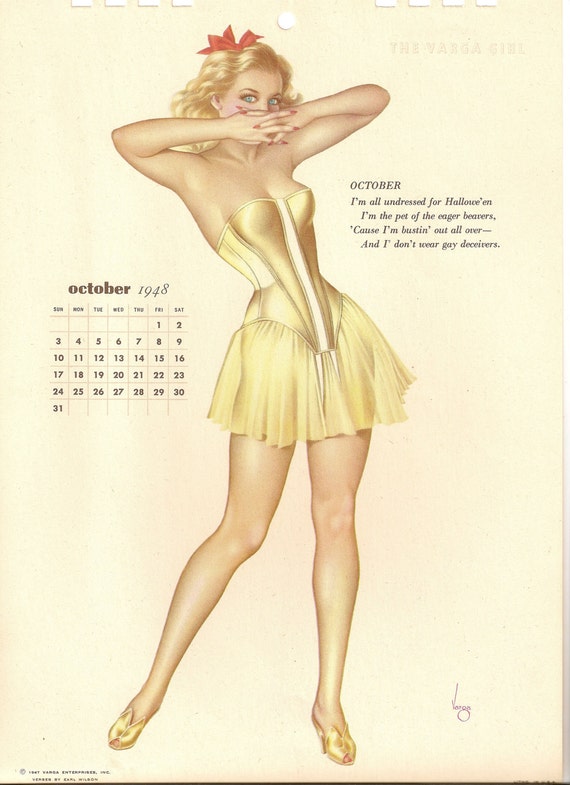

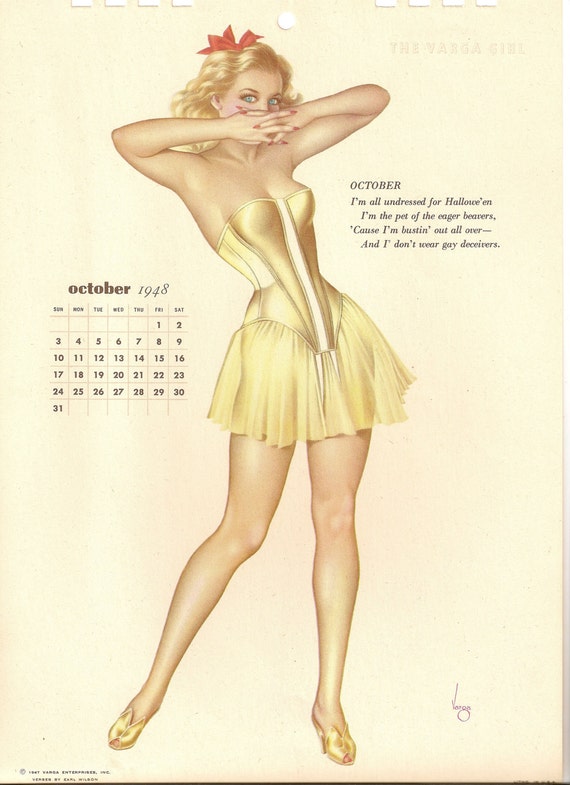

A Calendar Pin-Up Girl for October

It's October, and here's another pin-up girl painted by Alberto Vargas, the Peruvian artist who invented the pin-up girl. This one is the Esquire Calendar page for October 1948. If you were alive at the time, what were you doing then? Get out a magnifying glass and check out the poetry on the calendar page. Would (or could) anyone write anything like that today ... and get it published?

The Federal Government tried to take away Esquire Magazine's Second Class mailing privileges for publishing Vargas' art work. The magazine won in the Supreme Court, but Esquire stopped publishing them anyway. In the 1960s, Playboy Magazine took over the collection, publishing them periodically and saving Vargas from financial ruin. Thank you, Hugh Hefner!

JL

HOW TO BE ALERTED TO FUTURE BLOG POSTINGS.

JL

A Calendar Pin-Up Girl for October

It's October, and here's another pin-up girl painted by Alberto Vargas, the Peruvian artist who invented the pin-up girl. This one is the Esquire Calendar page for October 1948. If you were alive at the time, what were you doing then? Get out a magnifying glass and check out the poetry on the calendar page. Would (or could) anyone write anything like that today ... and get it published?

The Federal Government tried to take away Esquire Magazine's Second Class mailing privileges for publishing Vargas' art work. The magazine won in the Supreme Court, but Esquire stopped publishing them anyway. In the 1960s, Playboy Magazine took over the collection, publishing them periodically and saving Vargas from financial ruin. Thank you, Hugh Hefner!

JL

HOW TO BE ALERTED TO FUTURE BLOG POSTINGS.

Most readers of this blog are alerted by Email

every time a new posting appears. If you wish to be added to that

Email list, just let me know by clicking on Riart1@aol.com and sending me an

Email.

HOW TO CONTACT ME or CONTRIBUTE MATERIAL TO JACK'S

POTPOURRI.

BY CLICKING ON THAT SAME ADDRESS, Riart1@aol.com YOU ALSO

CAN SEND ME YOUR CONTRIBUTIONS TO BE PUBLISHED IN THIS BLOG AS WELL AS YOUR

COMMENTS. (Comments can also be made by clicking on the "Post a

Comment" link at the blog's end.)

MOBILE DEVICE ACCESS.

DID YOU KNOW THAT www.jackspotpourri.com IS ALSO

AVAILABLE ON YOUR MOBILE DEVICES IN A MODIFIED, EASY-TO-READ, FORMAT?

HOW TO VIEW OLDER POSTINGS.

To view older postings on this blog, just click on the

appropriate date in the “Blog Archive” midway down the column off to the right,

or scroll down until you see the “Older Posts” notation at the very

bottom of this posting. The “Search Box” in the

right side of the posting also may be helpful in locating a posting topic for

which you are looking.

HOW TO FORWARD

POSTINGS.

To send this posting to a friend, or enemy for

that matter, whom you think might be interested in it, just click on the

envelope with the arrow on the "Comments" line directly below,

enabling you to send them an Email providing a link directly to this posting.

You might also want to let me know their Email

address so that they may be alerted to future postings.

Jack Lippman

No comments:

Post a Comment